On March 26th, local time, the Office of the US Trade Representative announced that the investigation on "digital service tax" of Austria, India, Italy, Spain, Turkey and Britain had entered the next stage according to Section 301 of the US Trade Act of 1974. Possible measures at present include imposing punitive tariffs on the above-mentioned countries.

△ Reuters: The US Trade Representative said that he was prepared to impose tariffs on six countries for digital tax.

According to Reuters, US Trade Representative Qi Dai said that the United States is prepared to impose potential tariffs on these six countries in retaliation for the digital service tax imposed on the United States by these countries. In response to the digital service tax imposed by France on the United States, the United States may impose higher retaliatory tariffs on goods such as champagne, cosmetics and handbags worth $1.3 billion imported from France.

Why does the United States conduct a "301 investigation" on many countries and plan to impose retaliatory tariffs? What are the differences between the United States and its trading partners over the digital service tax?

In response to the digital transformation of the economy, the European Union took the lead in proposing digital tax.

According to the data of the World Bank, the digital economy has created 15.5% of the global GDP, and its growth rate in the past 15 years is 2.5 times that of the global GDP. More and more multinational technology companies have created great commercial value in the field of digital economy. But it also poses a great challenge to the global tax system based on the traditional economic model.

For example, according to the Tax Foundation of the United States, through the digital economy, enterprises can obtain users from abroad and make profits. However, under the existing international tax treaties, enterprises do not need to pay corporate income tax in the country because they have no physical presence in the country.

In response to the accelerated transformation of economic digitalization, the EU took the lead in proposing the "Digital Service Tax Proposal" in March 2018 to promote the EU’s tax reform. Digital service tax, referred to as digital tax for short, refers to the effective profits generated by some digital services (Internet services), and its collection targets are mostly large Internet companies.

However, this proposal has not reached a consensus at the EU level and has not been adopted. Since then, individual member States of the European Union have begun to formulate their own plans.

△ Reuters: The French Senate approved the taxation of digital tax, and the United States launched an investigation into this.

In July 2019, the French Senate passed a bill to levy a digital tax, becoming the first country in the world to levy a digital tax. According to the bill, France will levy a digital tax on Internet companies with global annual income exceeding 750 million euros and income from France exceeding 25 million euros, and the tax rate is 3% of the French market income.

Subsequently, Britain, Spain, Italy and other countries also implemented unilateral tax actions for their own interests.

Europe: American technology giants make huge profits and enjoy low taxes

△CNBC: Silicon Valley giants are accused of tax evasion of more than 100 billion US dollars in the past decade.

According to the US media CNBC report, Fair Tax Mark, a British tax research institution, found that between 2010 and 2019, six American technology giants, including Facebook, Apple, Amazon, Netflix, Google and Microsoft, evaded taxes totaling more than $100 billion. The researchers further pointed out that tax evasion "almost certainly occurred outside the United States."

According to British media reports, Amazon UK’s total tax bill in 2017 was 1.7 million pounds, less than 0.1% of its turnover of 2 billion pounds; Facebook set a record sales of 1.65 billion pounds in the UK in 2018, but it paid only 28.5 million pounds in corporate tax that year.

Margaret Hodge, a British MP, said that such a low tax amount is simply "outrageous".

△ French Minister of Finance Bruno Le Mayer

Bruno Le Maire, the French finance minister, accused American technology giants of "evading" taxes by setting their European headquarters in "tax havens" such as Ireland and Luxembourg. It is obviously unfair for these American companies to earn a lot of money in doing business in France, Germany and other places, but enjoy the low tax treatment in Ireland and Luxembourg.

Many European countries believe that the current tax system is mainly formulated for traditional enterprises, but there are many gray areas for emerging Internet enterprises, which leads to insufficient tax payment by Internet enterprises. Therefore, all countries are making efforts to formulate digital taxes and standardize the commercial taxation of Internet companies.

United States: Whoever collects digital tax will get revenge.

In fact, it is not surprising that the United States has imposed punitive tariffs on countries that levy digital taxes.

△ Wall Street Journal: The United States announced an investigation into France’s digital tax plan

In 2019, France adopted a digital tax plan, and the taxation targets mainly involved American technology giants such as Apple, Facebook and Amazon. Subsequently, the US government launched a "301 investigation" on the French digital service tax in July 2019 on the grounds that "France treated American enterprises unfairly".

△ Wall Street Journal: The United States and France may face 100% tariffs against French wines because of digital taxes.

In December 2019, the Office of the US Trade Representative announced the results of the "301 Survey", saying that the French digital tax "discriminates against American companies, contradicts the current principles of international tax policy, and imposes an unusually heavy burden on the affected American companies", and suggested that the United States impose tariffs on French goods exported to the United States as retaliation.

△ Wall Street Journal: The United States withdrew from global digital tax negotiations

After some consultations, in January 2020, the United States and France announced a temporary truce and started negotiations. At the same time, negotiators from many countries tried to reach a multilateral agreement on how to levy digital taxes on cross-border Internet companies through the framework of the Organization for Economic Cooperation and Development. However, in June of the same year, the then US Treasury Secretary Mnuchin unexpectedly announced the suspension of negotiations and warned that he would retaliate against any country that imposed a digital tax on American technology companies.

△ Wall Street Journal: Trump administration’s struggle to upgrade global digital tax

In June, 2020, the Office of the United States Trade Representative announced that it had launched a trade investigation against the European Union and nine countries, including Britain, Austria, Czech Republic, Italy, Spain, Turkey, Brazil, India and Indonesia, in order to counter their digital tax proposals.

△ Wall Street Journal: The United States will impose tariffs on French goods in response to France’s digital tax.

In July 2020, the Office of the US Trade Representative issued a statement that if France does not give up the new digital tax plan, the United States will impose an additional 25% tariff on goods worth $1.3 billion from France.

Digital tax further escalates and complicates the trade disputes between the United States and Europe.

With the spread of the COVID-19 epidemic, countries’ financial burden has increased and tax revenue has decreased, and more and more countries have begun to consider using digital tax to increase tax revenue, which will bring new burdens to American Internet companies.

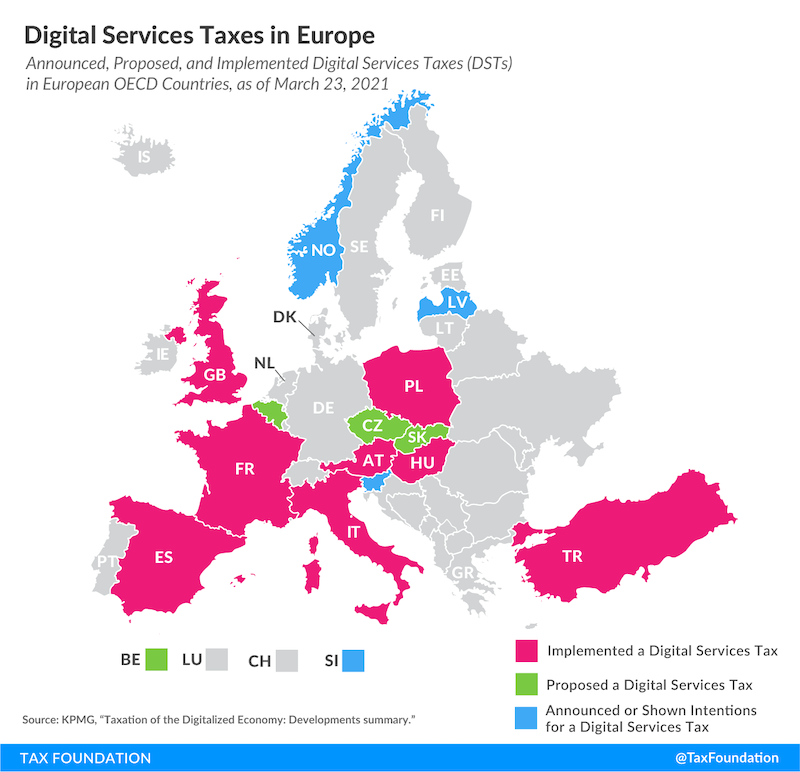

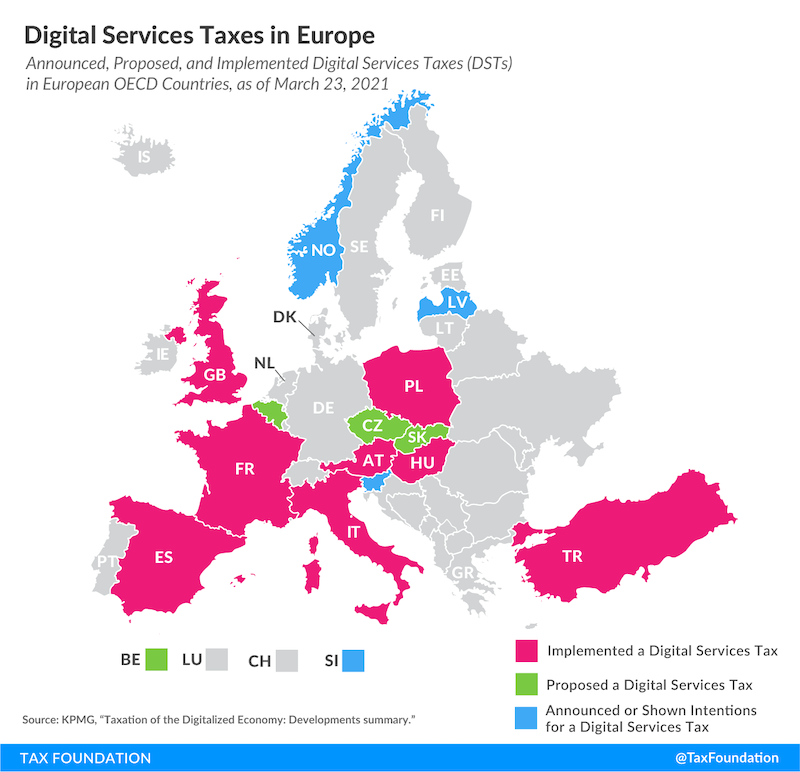

△ Image from the website of the US Tax Foundation

According to the public information on the website of the Tax Foundation of the United States, as of March 23, 2021, eight countries including Austria, France, Hungary, Italy, Poland, Spain, Turkey and the United Kingdom have implemented digital taxes; Belgium, Czech Republic and Slovakia have formed a proposal to levy digital tax; Latvia, Norway and Slovenia have announced or expressed their intention to levy digital taxes.

In fact, whether it is the digital tax proposal of the European Union or the digital tax that has been implemented in France, Italy and other countries, the threshold is quite high, and ordinary Internet companies are not affected by it. American Internet giant companies basically meet the standard of being taxed.

Although Biden’s administration has promised to reach a global agreement on digital tax, the Office of the US Trade Representative has announced that it intends to retaliate against six countries and will impose higher retaliatory tariffs on French imports.

The contradiction between the United States and Europe around the digital tax may not be solved overnight, and the trade differences between the two sides of the Atlantic will undoubtedly further expand.

Producer: Lu Yi

Producer Zhao Xinyu?

Editor-in-Chief: Cui Yi

Editor Zhang Baiyi